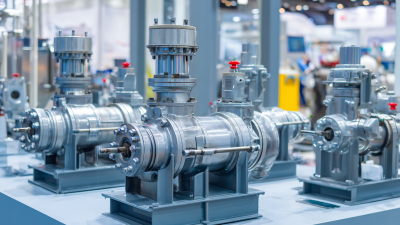

Top 10 Best Pumps for Oil to Enhance Efficiency and Performance

In today's industrial landscape, the efficiency and performance of oil transportation and handling systems are of paramount importance. The global demand for oil continues to rise, leading to a significant emphasis on optimizing operations within the sector. According to a report by the International Energy Agency (IEA), global oil demand is projected to reach 104 million barrels per day by 2025, underlining the necessity for reliable and effective equipment. A critical component of this optimization is the selection of the right pump for oil, which not only influences operational efficiency but also affects safety and maintenance costs.

With myriad options available in the market, determining the best pumps for oil requires careful consideration of various factors, including flow rate, viscosity, and environmental conditions. Recent advancements in pump technology have introduced innovative designs capable of enhancing performance while minimizing energy consumption. A study from the American Petroleum Institute (API) reveals that modern pumps can improve efficiency by up to 30% when compared to traditional models. As we delve into the "2025 Top 10" list of the best pumps for oil, we will highlight the products that stand out in terms of reliability, efficiency, and cutting-edge technology, helping industry professionals make informed decisions to bolster their operations.

Top Trends in Oil Pump Technologies for 2025: Innovations and Efficiency Gains

The oil pump industry is poised for significant advancements as we approach 2025, with a range of trends transforming the market. One of the most notable innovations is the integration of smart technologies into pump systems, allowing for real-time monitoring and predictive maintenance. By utilizing IoT devices, operators can optimize performance and reduce downtime, ultimately enhancing efficiency across operations.

Moreover, sustainable practices are becoming a focal point, led by the push for electric and eco-friendly pumping solutions that minimize environmental impact while maintaining high output levels.

In addition, advancements in materials and design methodologies are expected to play a critical role in efficiency gains. Lightweight composites and advanced alloys are emerging as alternatives to traditional materials, improving durability and performance under extreme conditions. This change is complemented by the trend towards modular designs that allow for easier upgrades and customization of oil pump systems. As these innovations unfold, businesses will not only increase operational efficiency but also position themselves strategically in a competitive marketplace, setting the stage for robust growth into 2026 and beyond.

Comparative Analysis of Electric vs. Mechanical Pumps in Oil Extraction Efficiency

In the ongoing evolution of oil extraction technology, the choice between electric and mechanical pumps serves as a critical factor influencing efficiency and performance. Electric pumps are generally favored for their precision and ease of automation, allowing for more consistent flow rates and the ability to integrate with advanced monitoring systems. Their lower maintenance needs and quieter operation also make them attractive in many applications, which is particularly beneficial for onshore oil extraction where noise and labor costs can be significant concerns.

Conversely, mechanical pumps often excel in environments where high pressures are common or where equipment is required to operate continuously for extended periods. These pumps tend to be more robust and can handle larger volumes of oil, making them suitable for offshore setups. Nevertheless, ongoing market trends indicate a notable shift towards the adoption of horizontal surface pumps, predicted to grow significantly from 522.79 million in 2025 to 687.91 million by 2033, at a compound annual growth rate of 3.4%. This trend suggests that while both types of pumps maintain distinct advantages, the market is favoring designs that optimize both efficiency and performance in oil extraction processes.

Top 10 Best Pumps for Oil to Enhance Efficiency and Performance

| Pump Type | Max Flow Rate (GPM) | Power Source | Efficiency Rating (%) | Maintenance Level |

|---|---|---|---|---|

| Electric Pump | 45 | Electric | 85 | Low |

| Mechanical Pump | 60 | Mechanical | 75 | Medium |

| Submersible Pump | 40 | Electric | 82 | Low |

| Diaphragm Pump | 30 | Pneumatic | 78 | Medium |

| Gear Pump | 50 | Mechanical | 80 | Medium |

| Positive Displacement Pump | 55 | Electric | 88 | High |

| Centrifugal Pump | 70 | Electric | 90 | Low |

| Lobe Pump | 65 | Electric | 87 | Medium |

| Peristaltic Pump | 25 | Electric | 79 | High |

| Vacuum Pump | 15 | Electric | 76 | Medium |

Key Performance Metrics: Understanding Flow Rate and Pressure in Oil Pumps

When selecting the best pumps for oil, understanding key performance metrics such as flow rate and pressure is essential. Flow rate, typically measured in gallons per minute (GPM) or liters per minute (LPM), indicates the volume of oil that the pump can move in a given time. A higher flow rate may be desirable for applications that require rapid oil transfer, such as in industrial settings or large vehicles. However, it’s crucial to ensure that the chosen pump's flow rate aligns with the specific requirements of the operation to avoid mishaps or inefficiencies.

Pressure is another vital metric that must be considered when evaluating oil pumps. Measured in pounds per square inch (PSI) or bar, pressure indicates the force with which the oil is pushed through the system. Adequate pressure ensures that the oil reaches its destination effectively, especially in complex piping systems or when overcoming elevation changes. Selecting a pump with the right pressure capacity is critical, as insufficient pressure can lead to reduced performance, while excessive pressure might result in equipment damage or leaks. Understanding both flow rate and pressure will ultimately enhance the efficiency and performance of oil handling systems.

Environmental Impact: The Role of Sustainable Pumping Solutions in Oil Industry

The environmental impact of the oil industry is profound, necessitating a shift towards sustainable pumping solutions. Research from the International Energy Agency (IEA) underscores that optimizing pumping systems can reduce energy consumption by 30%, which significantly lowers the carbon footprint associated with oil extraction and transport. Modern pumps are designed not only to improve efficiency but also to minimize greenhouse gas emissions, aligning with global sustainability goals.

Investments in innovative technologies, such as variable frequency drives (VFDs) and advanced monitoring systems, contribute to more sustainable oil production. According to a report by the Global Infrastructure Facility, transitioning to these technologies can lead to a reduction of up to 40% in energy usage within pumping operations. Moreover, utilizing pumps made from sustainable materials can further mitigate environmental impact, fostering a circular economy within the oil industry.

Emphasizing the importance of sustainability in pumping solutions is essential for the industry to meet both regulatory requirements and public expectations, highlighting a pathway towards a more eco-friendly operational model.

Future of Smart Pumps: Integrating IoT for Enhanced Oil Production Monitoring

The future of smart pumps in the oil industry is rapidly evolving, driven by the integration of the Internet of Things (IoT) technologies. These advanced systems enable real-time monitoring and data collection from pumps, allowing operators to gain insights into performance metrics that were previously difficult to obtain. By leveraging IoT capabilities, oil producers can optimize their operations, reduce downtime, and enhance overall efficiency.

Furthermore, the integration of IoT not only improves individual pump performance but also contributes to a more holistic understanding of the entire oil production process. With the ability to analyze data and track performance trends, companies can make informed decisions about maintenance schedules, energy consumption, and operational efficiencies. This predictive approach empowers operators to troubleshoot issues before they escalate, ultimately leading to a more sustainable and productive oil extraction environment. As the oil industry embraces these smart technologies, the potential for enhanced oil production monitoring will become increasingly significant.

Related Posts

-

Exploring the Future of Pump for Oil Innovations at the 138th Canton Fair 2025 in China

-

Exploring the Future of Oil Pumps: Innovations and Efficiency in Modern Machinery

-

What are Spark Plugs and How Do They Impact Your Engine's Performance?

-

Essential Guide to Choosing the Right Oil and Filter for Your Vehicle's Performance

-

Unlocking Fuel Oil: Understanding Its Importance and Impact on Today's Energy Landscape

-

Unlock Your Engine's Potential: The Ultimate Guide to Choosing the Right Spark Plugs